|

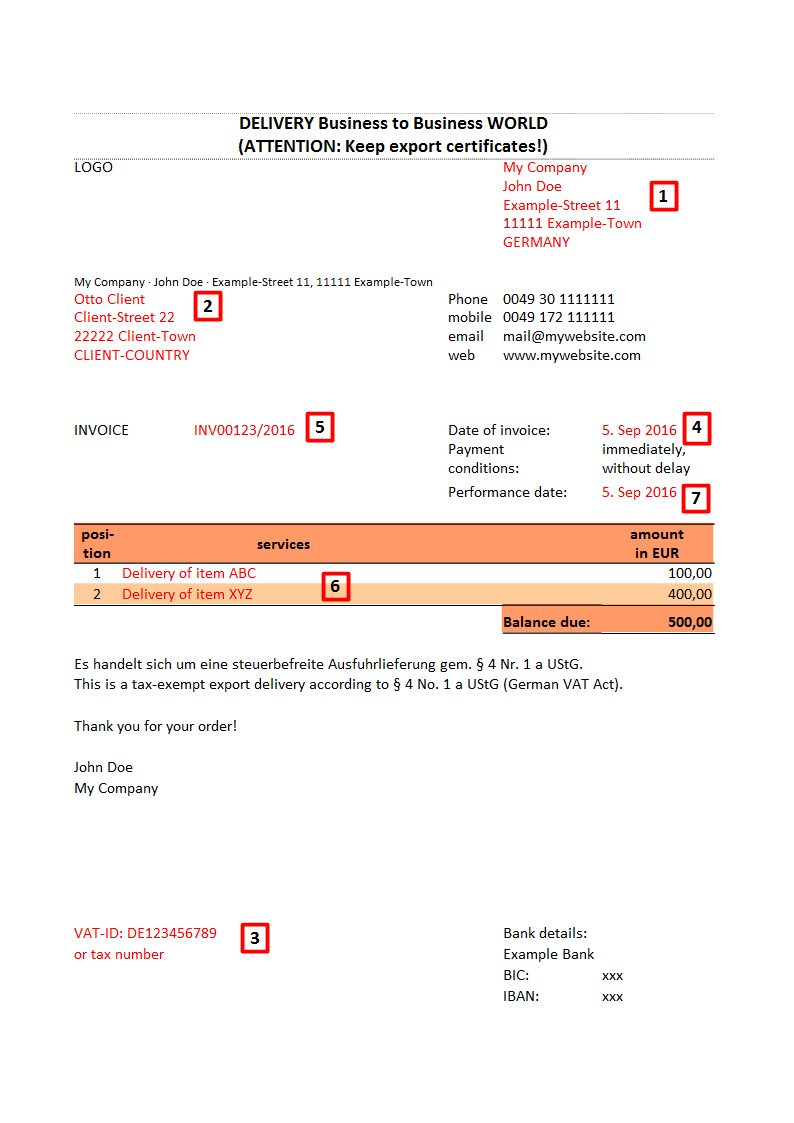

In Germany, strict regulations apply to a correct business to business invoicing for deliveries of goods (not services) between businesses located in and outside of the European Union. An invoice compliant with the German VAT law must include the following components: 1. name and address of the performing entrepreneur 2. name and address of the customer / invoice recipient 3. the tax number or the VAT identification number of the performing entrepreneur 4. the date of issue of the invoice 5. an ongoing invoice number 6. the description of the goods delivered or the services rendered 7. the date of delivery or service PLEASE CHECK OUT THE FOLLOWING SAMPLE INVOICE!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

FRANK LEHMANNMBA for Finance and Financial Services (UK), Steuerfachwirt (GER) Categories

All

|

RSS Feed

RSS Feed